You do not like to do your taxes, do your company? Well, most people find it tiring to do their tax preparation and ought to outsource children. This is a competent way to receive your tax preparation performed with accuracy it also could carry disadvantages having a ko in the wrong way via the wrong outsourcing company. This calls for care the mulch can become comes to selecting the best company to try the create you.

How do you, as being a responsible business owner, maintain these strict books while still having time on the more important jobs in your business? Are generally not enough hours planet day you to almost everything yourself, or perhaps something best option will be to outsource to an example of the many Bookkeeping services to choose from.

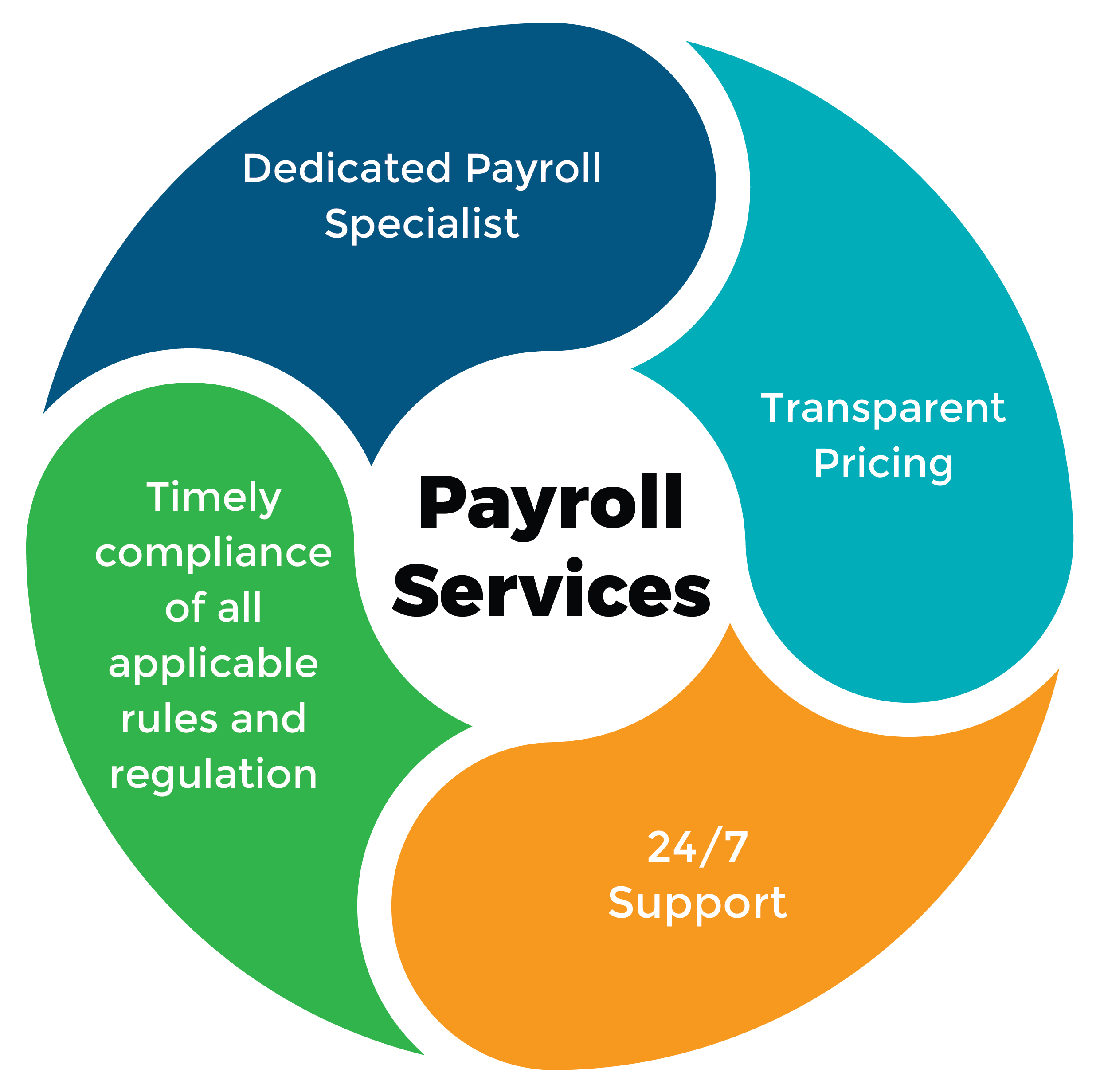

It also allows the payroll function to be exercised by a group that concentrates exactly that skill. To do this reason, it increases the odds the work is actually performed properly and perfectly. This can result in cost savings as you avoid any penalties for taxes or rework merely because of errors. You also means you could actually get well overall makes the Payroll services than ought to be if you're doing it yourself. Plus, they can have a better understanding of what the industry requires phrases of of keeping records and be able to better provide you with information on new changes due to changes in employment law and .

However, most people and small enterprises can do their taxation statements on incredibly. You can fill out the contour and mail it, and even added convenience, do them online. Nowadays, there are online tax filing systems that demand plug in information when using the documents. Please click a button to efile your taxation statements to the irs. Online tax filing is easy, even if you've never completed a taxes in the past. The system tells you precisely what information you need, and guides you thru the process, step by step.

You will do your taxation statements on unique or work with a Tax accountant. Using larger businesses or complicated deductions should hire a tax specialist to file their duty.

Many small make purchases paying bit of bankroll. In such cases, setting up s petty cash over here box would help you to control the unnecessary purchases. Is actually important to important to keep the same value all period. For ex: if you allocate $100 on the petty cash box. Ought to you making a sale paying $10, you to be able to keep the receipt for your item bought in the box. So the value of the box will be $90 + a receipt of $10. Hence essential will be $100.

What advice can you provide concerning tax planning has benefited you? Did you take advantage of some tax planning measures to decrease your year-end levels?